The Vertical Bloom: 11/20/25

Your guide on the happenings of the vertical drama landscape.

Welcome to The Vertical Bloom, a weekly dive into the fast-growing world of microdramas and vertical storytelling. Here, we unpack the platforms, creators, and deals shaping the format that’s quietly redefining what it means to make—and watch—television in the mobile age.

Fresh Takes

Holywater Releases First Un-Scripted Series, “Love or Dare”

Holywater is pushing into new territory with Love or Dare, its first unscripted vertical series rolling out on MyDrama starting November 21. The 80-episode run follows couples put through emotional and physical trials, including reality-TV regular Harry Johnson (Netflix’s Too Hot to Handle). Produced outside Holywater’s Fox partnership, the project marks a clear bid to test whether reality formats can thrive in microdrama pacing and scale. The question now is: will this become a one-off experiment—or the first real blueprint for unscripted vertical storytelling?

Disney Continues Their Path Into the Microdrama Boom.

At Disney+’s APAC Originals Preview in Hong Kong, the company continues to acknowledge the obvious: they’re stepping into microdramas. Just without a roadmap…yet. Eric Schrier, President of Disney Television Studios and Global Originals Television Strategy, admitted they haven’t locked a strategy but “will be in that space,” while Luke Kang, President of Disney Asia Pacific, framed microdramas as early-stage but too engaging to ignore. The timing isn’t accidental, this all comes one week after Disney publicly tapped DramaBox for its 2025 Accelerator, signaling that the studio is quietly laying the groundwork to make vertical storytelling part of its future playbook.

Pakistani Streaming Giant—Begin—to Launch Microdrama App

Begin, Pakistan’s fastest-growing streamer, with deals among the likes of Sony Pictures Entertainment and NBCUniversal—to name a few—is betting big on microdramas. A year into launch, the platform is building a dedicated vertical-drama app with Tencent—an unmistakable signal that short form, mobile-native storytelling is becoming central to its strategy in a country where half the population is under 30. The move positions Begin to compete not by outspending Netflix or local rival Tamasha, but by owning the fast-rising vertical drama format across Pakistan and the broader South Asian market.

A Look at ‘Crisp Conference 2025: The Future is Vertical…’

Key players in the microdrama ecosystem are heading to Seoul for The Future Is Vertical, Crisp’s industry summit designed to map the next chapter of short-form storytelling. Across the board, unlikely players are signaling how even adjacent industries can expand into this microdrama landscape. Neorigin’s Chen Bo and MoboReels’ Zou Jianfeng argue that gaming and ebooks naturally funnel into vertical dramas without cannibalizing their core users, while other executives focus on scaling into new markets, genres, and formats. The message is clear: the vertical era isn’t plateauing—it’s professionalizing, diversifying, and accelerating.

A quote from Crisp CEO Adrian Cheng:

“I think short-form content is already a global trend…You’re seeing a very big paradigm shift in Asia already, and of course in the U.S. and also in Europe. It’s a new form of moving image being redefined in Asia, not Hollywood.”

Platform Spotlight

DramaDash, a Turkish-based platform, is carving out a spot in the vertical ecosystem with its regionalized content that expands genres and formats not found on many other platforms. Apart from its romantic series’, DramaDash has found success with thrillers, action, mystery, and even comedy, to deliver a diverse portfolio of content. Although based in Turkey, the majority of their most popular series are in English, reflecting an expansion into the American market. DramaDash shows a unique direction amidst the global microdrama space—where multiple genres are being reimagined for vertical storytelling rather than retrofitted from longer formats.

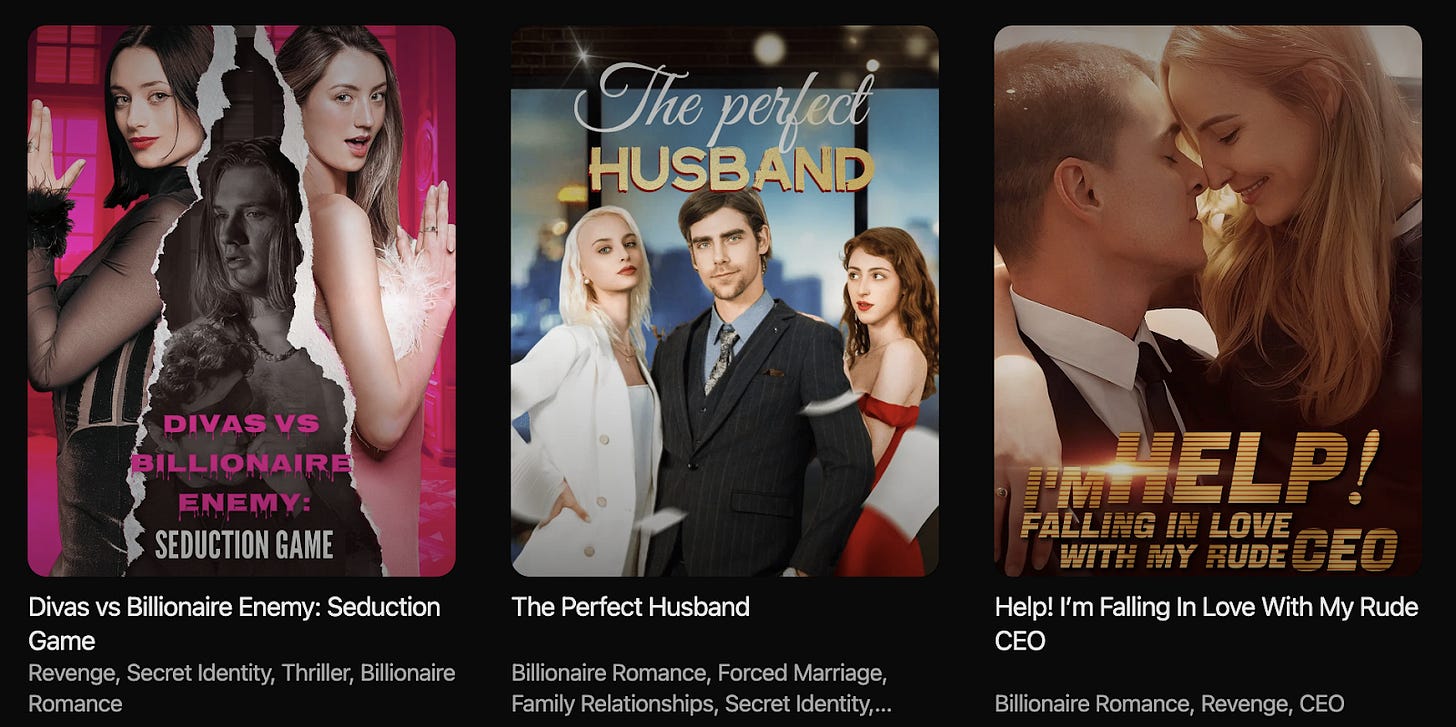

Show Spotlight

The Secret Life of Amy Bensen (Vigloo):

Logline: After losing her entire family, Amy has spent several years on the run from unknown danger. When she meets Liam on a flight she has no idea her life is about to change, for his part Liam plans to help her whether she likes it or not.

Genre: Romance / Drama / Thriller

This 35-part series on Vigloo doesn’t disclose its view count, but the built-in audience from its original IP, a New York Times Best-Selling Book Series, is hard to miss—active in fan forums, review threads, and dedicated blogs. Each episode runs about 90 seconds, and while the story wasn’t originally written for this medium, its sleek production value, genre mix, and pacing align perfectly with what dominates top-performing charts. What truly sets it apart, however, is its heightened eroticism—earning an X-rating on the platform and sparking conversations around how vertical dramas are reshaping boundaries of censorship and creative freedom in short-form storytelling.

To understand what this kind of success means for the industry, I turned to the people shaping it behind the scenes…

Industry Insider

Creative Producer turned Microdrama Insider Thom Woodley raises an essential question: What happens to the IP of the creatives who write and make the series’? Most platforms demand full ownership of original stories while paying writers flat, work-for-hire fees—no buyout premium, no royalties, no upside.

That’s especially troubling, Woodley says, because he thinks that the strongest microdramas aren’t adaptations of Chinese hits but fresh concepts from original creators, and that’s exactly what will continue to attract audiences to this medium. When these creators are being forced to surrender IP that platforms rarely even use for sequels or franchise building, the result is a system treating stories as disposable content instead of assets. If the platforms aren’t building long-term value from these stories, why are writers being asked to give theirs away?

Great article. Many of these apps you mentioned, from My Drama to DramaDash, are our partners and use our content to grow at the early stage. We have produced 80 high quality English micro-dramas and still fully own the IPs worldwide. For anyone who's interested in licensing readily available micro-drama titles, please feel free to drop me a message at contact@getbriz.com.

The barrier to entry seems lower on verticals so that I think a lot of us creators who write our own IP are just going to produce our own content and not bother with these platforms if they're asking us to give up all rights.